irs unemployment benefits tax refund

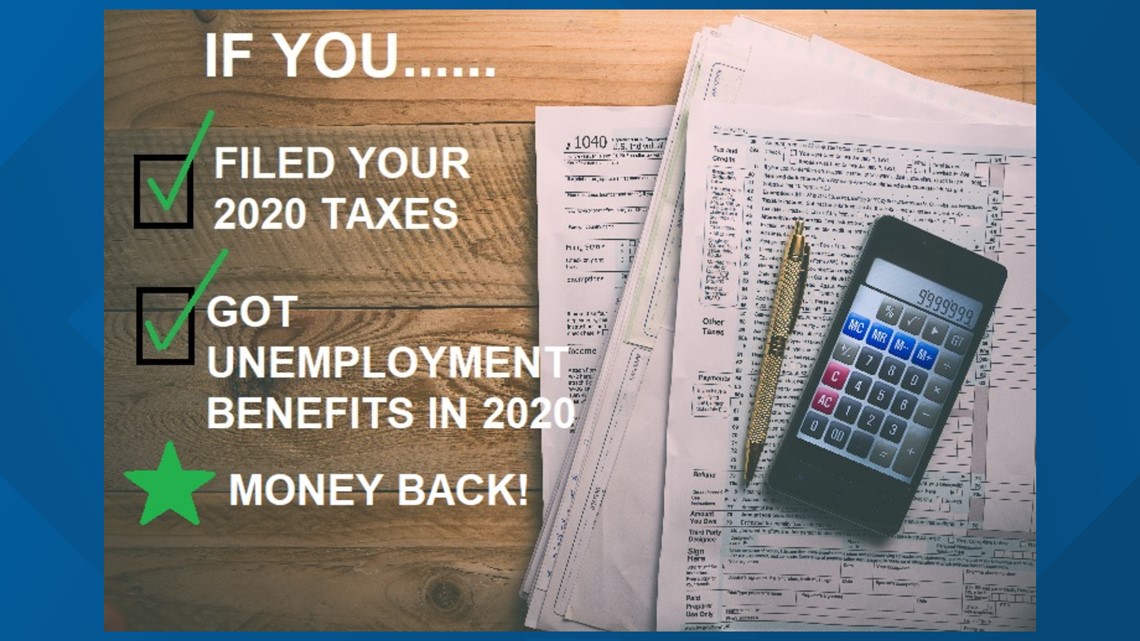

Normally any unemployment compensation someone receives is taxable. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

You should receive Form 1099-G Certain Government Payments showing the amount of unemployment compensation paid to you.

. The first jobless benefits worth 10200 were defined as non-taxable in March in Bidens American Rescue Plan. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Taxpayers should not have been.

When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. The IRS will continue reviewing and adjusting tax returns in this. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144.

If you received unemployment benefits. The IRS began performing the corrections starting in May 2021 and continues to review tax year 2020 returns and process corrections to issue any applicable refund that is. Billion for tax year 2020.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. If you filed a 2020 return and reported the unemployment benefits as fully taxable and we processed your return on that basis then you should receive a separate adjustment. A quick update on irs unemployment tax refunds today.

IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and. An advance payment of the Child Tax Credit this will show as being from the IRS and will show as IRS TREAS 310 with a description of CHILDCTC. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200.

Unemployment tax exemption This refund under the exemption is 10200 and may reach millions of Americans in the coming days as part of another effort to issue a recent round of payments. Check The Refund Status Through Your Online Tax Account. However a recent law change allows some recipients to not pay tax on some 2020 unemployment.

Unemployment refunds are scheduled to be processed in two separate waves. Is Unemployment Taxed H R Block With the fourth batch of payments now going out. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The IRS announced earlier this month that the agency had begun the process of adjusting tax. Getty For folks still waiting on the Internal Revenue. The agency reported that the average payment for a tax refund is 1265 and most recipients will not have to complete any action to get the payment.

Call our automated refund. The Internal Revenue Service IRS will issue an additional 15 million tax refunds averaging more than 1600 this week to filers who paid too much in taxes for their 2020. The IRS will continue to.

But 13 days later. Dwd Will Collect Unemployment Overpayments From Tax Refunds In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on. Millions of Americans who collected unemployment benefits last year and paid taxes on that money are in line to receive a federal refund from the IRS this week.

However the American Rescue Plan passed in March decreed that up to 10200 in jobless benefits would. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

On May 14 the IRS announced that tax refunds on 2020 unemployment benefits would begin to be deposited into taxpayer bank accounts within the week. Normally unemployment benefits are subject to federal income tax. Report Unemployment Compensation.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. 1 1Your tax refund may be late. Taxpayers who had filed their tax returns earlier than the.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Tax Refund 169 Million Dollars Sent This Week

Irsnews On Twitter Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent Changes Made

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

2020 Unemployment Tax Break H R Block

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Sends 2 8 Million Additional Refunds To Taxpayers For Unemployment

Tax Refund Irs Says 2 8m Will Get Overpaid Unemployment Money Returned This Week Kxan Austin

Irs To Recalculate Taxes On Unemployment Benefits Refunds To Start May 2021 Tax Pro Center Intuit

Irs Unemployment Benefits And Tax Refunds Fingerlakes1 Com

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Stimulus Check Updates News On Irs Tax Refunds Child Tax Credit California Stimulus Unemployment Benefits Lee Daily

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

1099 G Unemployment Compensation 1099g

Irs Issues Another Round Of Unemployment Tax Refunds To 1 5m Americans Fox Business

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com